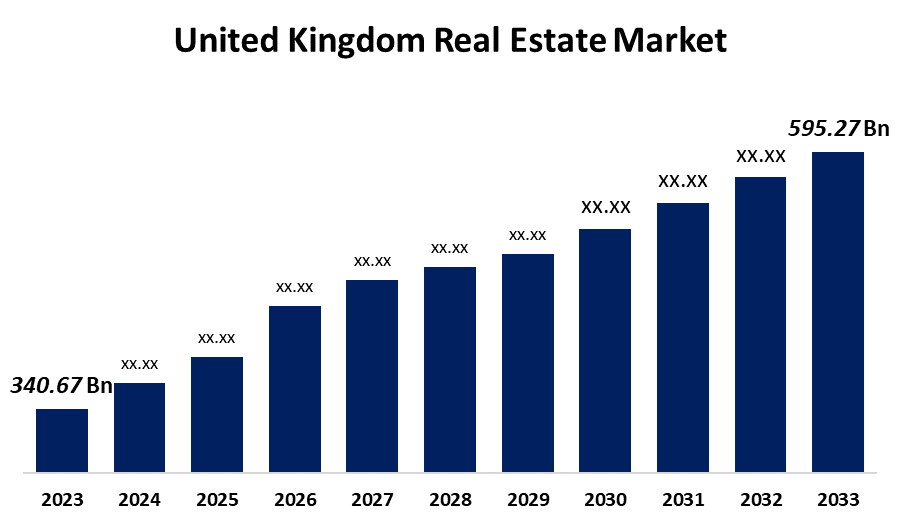

The UK real estate market forecast 2025 shows a landscape of cautious optimism, driven by modest house price growth, easing interest rates, and persistent rental demand. Buyers, renters, and investors are all closely watching trends that could influence decisions in the coming year. Understanding the nuances of the market is essential for anyone planning to enter or invest in UK property in 2025.

Economic uncertainty and affordability challenges continue to shape the UK real estate market forecast 2025. While house prices are expected to increase modestly, rental demand remains high, particularly in urban centres and student towns. Investors with a long-term perspective can still find opportunities, while buyers must carefully assess affordability and financing options before making commitments.

UK Housing Market Overview 2025

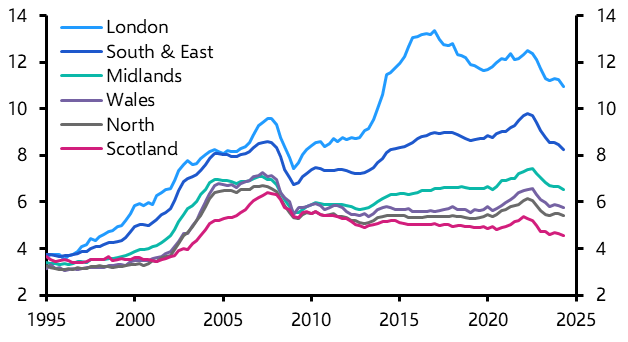

The UK real estate market forecast 2025 highlights significant regional variation, with London and the South East remaining expensive, while Northern England and Wales present more accessible opportunities. Housing market activity has been subdued in recent years due to high entry costs, yet the market has shown resilience with steady sales and rental growth. Understanding these regional trends is crucial for effective property investment and purchasing strategies.

Historical data suggests that despite slow growth in the mainstream housing market, certain sectors, such as high-demand urban residential properties, continue to perform well. Comparing the UK to other European markets reveals a relatively stable outlook, with moderate gains expected in house prices and continued strong demand for rental properties. This resilience is a key factor in the UK real estate market forecast 2025.

House Price Forecasts for 2025

House prices in the UK real estate market forecast 2025 are projected to grow between 1% and 4% nationally, reflecting both economic recovery and ongoing affordability challenges. Key drivers of this growth include anticipated cuts to Bank of England interest rates and sustained demand for urban residential properties. Buyers and investors should focus on regions where growth could exceed national averages.

For first-time buyers, affordability remains a major hurdle. The cost of deposits and high property prices relative to income may delay entry into the market. However, long-term projections suggest that investing in property remains a sound strategy for those planning to hold assets over several years. Strategic purchases in growth regions can offer strong returns, reinforcing the outlook of the UK real estate market forecast 2025.

Interest Rates and Mortgage Trends

Interest rates are central to the UK real estate market forecast 2025, with expectations of Bank of England rate reductions easing borrowing costs. Lower rates can encourage buyers to enter the market, support higher house prices, and make mortgages more affordable. Investors and homeowners should closely monitor these trends when planning financial strategies for 2025.

The mortgage landscape is also evolving, with a variety of competitive products available to potential buyers. Fixing mortgage rates early can protect against future increases, while flexible options may benefit those seeking investment properties. Understanding the relationship between interest rates, property prices, and rental yields is crucial for navigating the UK real estate market forecast 2025 successfully.

Rental Market Insights

Rental demand continues to play a significant role in the UK real estate market forecast 2025. Limited housing supply, particularly in urban centres, has driven rental growth across the country. Tenants face rising costs, while investors benefit from attractive yields in high-demand areas. Keeping an eye on rental trends is vital for anyone involved in the property market.

Urban and university towns are likely to see sustained rental growth, reflecting ongoing population movements and housing shortages. Buy-to-let investors may find opportunities to capitalise on long-term rental demand. Understanding rental market dynamics provides an important perspective for the UK real estate market forecast 2025, particularly for those weighing investment and affordability decisions.

Investment Opportunities and Risks

The UK real estate market forecast 2025 presents both opportunities and risks for investors. Residential property remains a safe long-term option due to consistent demand, while select commercial and industrial sectors may offer higher returns but with increased volatility. Strategic planning and risk assessment are critical for maximising potential gains.

Challenges such as regional price variation, economic uncertainty, and affordability issues must be considered. Investors who adopt a long-term approach and focus on resilient regions may achieve strong returns despite market constraints. Evaluating both potential rewards and risks ensures that investment decisions align with the realities of the UK real estate market forecast 2025.

Key Challenges for Buyers in 2025

Affordability continues to be the central challenge highlighted in the UK real estate market forecast 2025. High house prices, significant deposit requirements, and limited housing stock create barriers for first-time buyers. Careful financial planning and market research are essential to overcome these obstacles and identify viable purchasing opportunities.

Regional differences and mortgage rate fluctuations add additional complexity for buyers. Urban centres may offer limited affordable options, while peripheral regions can provide better entry points. Understanding these challenges helps buyers make informed decisions and take advantage of trends outlined in the UK real estate market forecast 2025.

Market Outlook Summary

Overall, the UK real estate market forecast 2025 points to slow but steady growth in house prices, strong rental demand, and selective investment opportunities. Buyers, renters, and investors should focus on research, timing, and regional variations to maximise returns. Strategic planning is key to navigating this evolving market.

Despite affordability pressures, the market has shown resilience and potential for long-term gains. Interest rate trends, rental growth, and regional performance will continue to influence the landscape. By understanding these factors, stakeholders can make informed decisions and benefit from the UK real estate market forecast 2025.

FAQs

Will UK house prices rise in 2025?

Yes, the UK real estate market forecast 2025 anticipates modest house price growth between 1% and 4%, influenced by easing interest rates and sustained demand.

Which regions will see the highest property growth?

High-demand urban areas may experience moderate growth, while Northern regions and Wales could offer better affordability and attractive long-term returns.

How will interest rates affect buyers in 2025?

Anticipated Bank of England rate cuts may reduce borrowing costs, encouraging buyers to enter the market and supporting house price growth.

Is 2025 a good year to invest in property?

Investors with a long-term strategy may find opportunities in both residential and select commercial properties despite affordability challenges.

What should first-time buyers know about the 2025 market?

Affordability and deposits are key considerations. Careful research, strategic planning, and understanding regional variations are essential.

How will rental prices change in 2025?

Rental prices are expected to continue rising, driven by high demand and limited housing supply in urban and university areas.

Which property sectors are most resilient in 2025?

Residential property remains the most stable sector, while select commercial and industrial sectors may provide growth potential with managed risk.

You may also read: Student Accommodation Investment UK: Complete 2025 Guide to High-Yield Properties