Buying a home in the UK is an exciting milestone, but it also comes with financial responsibilities that go beyond the property price. One of the most significant additional costs is stamp duty, a tax that can catch buyers off guard if not planned for in advance. This is where a stamp duty calculator UK becomes invaluable, as it provides a clear and instant estimate of how much Stamp Duty Land Tax you will owe.

In 2025, changes to stamp duty thresholds and rates are expected, making it even more important for buyers to stay informed. Using a reliable calculator saves time, prevents mistakes, and ensures you can budget properly before committing to a purchase. Whether you are a first-time buyer, moving to a new home, or investing in a buy-to-let, a stamp duty calculator UK is the best way to prepare for your financial obligations.

What is Stamp Duty and Why Do You Pay It

Stamp duty, officially called Stamp Duty Land Tax (SDLT) in England and Northern Ireland, is a government tax charged on property or land transactions above a certain value. Scotland operates under Land and Buildings Transaction Tax, while Wales applies Land Transaction Tax. Despite the different systems, the principle remains the same: buyers must pay a portion of their property’s value as tax.

The amount payable depends on various factors such as the property price, whether you are a first-time buyer, and if the purchase involves a second home. Many buyers ask, how much is stamp duty, and the answer is not always straightforward. That is why using a stamp duty calculator UK is crucial, as it removes the guesswork and provides accurate figures based on your personal situation.

How the Stamp Duty Calculator UK Works

A stamp duty calculator UK is a simple tool designed to make property purchases more transparent. By entering details such as the purchase price, your buyer status, and property type, the calculator instantly shows your stamp duty liability. This enables you to factor the tax into your budget long before completion, reducing financial stress later in the process.

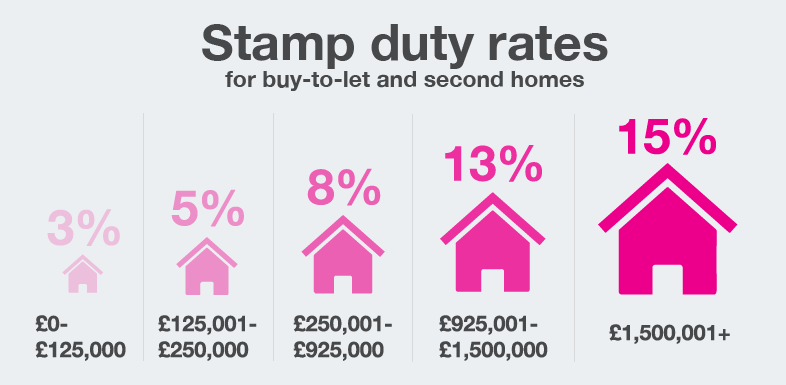

Different scenarios influence the results provided by the calculator. For instance, first-time buyers benefit from relief that lowers their tax bill, while buy-to-let investors and second-home buyers face additional surcharges. With these variations, relying on a stamp duty calculator UK is essential for getting a personalised estimate that reflects your exact circumstances.

Stamp Duty Rates 2025 – Updated Rules and Thresholds

Stamp duty is not static, and rates are subject to government updates. In April 2025, new rules are expected to come into effect, which will change thresholds and percentage bands. This means the amount payable may be higher or lower depending on the property value. Using a stamp duty calculator 2025 ensures you stay aligned with the most up-to-date information.

Residential homes, second properties, and non-UK resident purchases all have different rate structures. For example, non-resident buyers typically pay an additional surcharge. With so many rate variations, it is difficult for the average buyer to calculate manually. This is where a stamp duty calculator UK proves indispensable, giving you an accurate result within seconds.

Regional Differences in Scotland and Wales

The UK property market is diverse, and stamp duty rules vary across regions. In Scotland, homebuyers pay Land and Buildings Transaction Tax, while in Wales the system is called Land Transaction Tax. Each of these has its own thresholds, exemptions, and rates, which can make calculating tax even more complicated for those moving between nations.

Buyers in England and Northern Ireland use a stamp duty calculator UK tailored to SDLT, while those purchasing in Scotland or Wales should seek calculators specific to their regions. Understanding these differences is important because assuming the same rules apply nationwide could result in financial miscalculations and budget shortfalls.

Stamp Duty for First-Time Buyers

For first-time buyers, stamp duty relief is one of the biggest advantages when entering the housing market. Depending on property value, first-time buyers may pay no stamp duty at all or benefit from reduced rates. A stamp duty calculator UK is an effective way to see if you qualify for these savings before committing to a purchase.

However, as with all tax policies, reliefs and allowances are subject to change. With stamp duty changes 2025 approaching, it is vital for new buyers to keep track of government announcements. The calculator provides an easy and instant way to check if you remain eligible for reduced rates and ensures you are not taken by surprise on completion day.

When and How to Pay Stamp Duty

Stamp duty must be paid within 14 days of completing a property purchase. While your solicitor or conveyancer will usually arrange payment, the legal responsibility ultimately lies with you as the buyer. Failure to pay on time can lead to fines and additional interest charges, which can significantly increase the overall cost.

Payment is made directly to HMRC, and the process is straightforward once you know the amount owed. A stamp duty calculator UK plays a vital role here, as it helps you prepare funds in advance and avoid last-minute delays. By knowing your liability early, you can move forward with confidence and meet your legal obligations smoothly.

Stamp Duty Changes 2025 – What Buyers Need to Know

The government has confirmed adjustments to stamp duty thresholds and rates in 2025, and these changes will impact a wide range of buyers. First-time buyers, movers, investors, and overseas purchasers may all be affected differently. By using a stamp duty calculator 2025, you can quickly see how the updates apply to your personal situation.

Changes to stamp duty often influence the wider housing market. When thresholds are raised or lowered, buyer behaviour shifts, affecting property demand and prices. Keeping informed through the stamp duty calculator UK ensures you remain aware of any financial implications, allowing you to plan your purchase wisely and avoid unexpected challenges.

Conclusion

Stamp duty is an unavoidable cost for most property purchases in the UK, but with the right preparation it does not have to be overwhelming. By using a stamp duty calculator UK, you can gain clarity on your financial responsibilities, whether you are a first-time buyer or an experienced investor. This tool provides instant, reliable figures tailored to your exact circumstances.

As stamp duty changes 2025 approach, staying informed is more important than ever. From understanding rates and thresholds to planning payment deadlines, the calculator ensures you remain financially ready. In a property market that is constantly evolving, using a stamp duty calculator UK is the simplest and smartest way to prepare for your next move.

FAQs About Stamp Duty Calculator UK

- How much is stamp duty in the UK for 2025?

- Do first-time buyers still pay stamp duty in 2025?

- When do you pay stamp duty after buying a home?

- What are the new stamp duty rules in April 2025?

- Do I pay stamp duty on buy-to-let or second homes?

- How does stamp duty work in Scotland and Wales?

- Can I avoid or reduce my stamp duty legally?

- What happens if stamp duty is not paid on time?

- Is there a difference between residential and non-residential stamp duty?

- Which is the best stamp duty calculator UK to use in 2025?

You may also read: Creative Ways to Sell a House Fast